Homeschooling: expert advice for parents with primary-aged children

Educating your children at home? MoneySense is here to guide you through the different ways you can teach your children about money, while calling on some experts to share their homeschooling tips.

Teaching your children at home can be a hugely rewarding experience, but may also feel a little daunting to begin with. Help is at hand: we asked leading child psychologist Dr Elizabeth Kilbey and homeschooling expert Anna Dusseau – a qualified teacher and the writer behind the Homeschool Guru blog – for their top tips.

1. Create structure…

“It isn't possible to imitate a full school routine with home education,” says Anna. Instead, create a basic timetable for each day, but be flexible. “Homeschooling is a shuffle, not a playlist. If you wanted them to begin with maths and they get stuck into some amazing cardboard modelling, let them go with that. Maybe maths will happen later in the day. Plenty of exercise, play time and reading are essential for brain development and will also assist with concentration when there is more technical learning to be done.” Alongside school work, why not try and find learning opportunities in your everyday life: ask your child to help cost-up your next shopping list, complete these activities especially designed for when you’re stuck indoors or plan a family day out for the future.

2...But be realistic

Having a sense of routine to your days will be helpful, but don’t be a slave to it. “Structure is important,” says Dr Kilbey. “But it’s there to help, not to be stress-inducing. Having a schedule is like having a roadmap of how you’re going to get through today and tomorrow, but flexibility is also important.”

Identify what is working for your own family, because feeling at ease in times of anxiety is important. “This time is all about survival and prioritising mental wellbeing above all else,” says Anna. “No child can concentrate and achieve in a stressed environment.”

3. Take advantage of educational resources

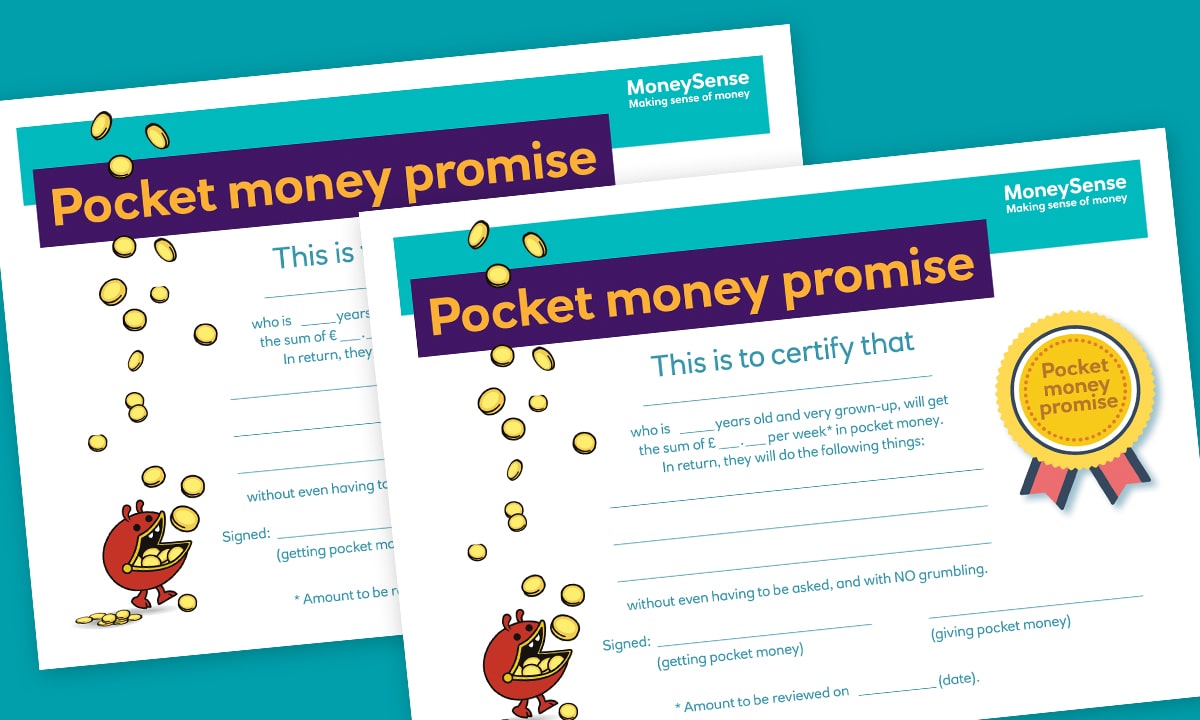

There are lots of resources available online to help your children learn at home, including a whole host of MoneySense activity sheets covering different topics that will develop their money knowledge as well as other skills. For example, making a vision board combines art with learning about saving, while the money map poster blends geography with learning about different currencies. Now is also a good time to learn more about digital money and different ways to pay quiz. You’ll find lots more fun activities for children of all ages here.

Do also keep an eye on your child’s screen time when they’re learning at home, and what they’re doing while online. Use this opportunity to teach them awareness of online fraud and encourage them to play the fun Scam Busters game.

4. Follow their lead

“Children need time to adjust to a new situation before they click with what's going on and begin motivating themselves, so try to keep the mood light and positive,” says Anna. “Take breaks every 50 minutes or less and properly let go with creative play, den building, reading, a craft activity, or a walk in the fresh air. This means that when your children return to learning their concentration is at peak level, they feel good and, importantly, it doesn't feel like a chore.”

5. And finally…stay calm!

The current lockdown can be stressful for both adults and children, but do your best to create a calm environment. “Children are very affected by the emotional climate they’re living in,” explains Dr Kilbey. “However, children adapt very quickly, so if the people around them are calm, they’ll feel calmer too. Try to take one day at a time and don’t sweat the small stuff.”

Dr Kilbey recommends acknowledging any concerns your child’s may have, and reassuring them wherever possible. “Make sure you use simple language, and keep the messages basic and positive – reassure them that, while things are tough, we believe it’s going to be ok.”

Money topics to tackle with your child

Extra time at home creates the perfect opportunity to make sure your little ones are getting a good grounding in the money basics. For primary-aged children, those topics will include:

How to manage money = understanding the value of notes and coins, how to keep track of their money.

Becoming a critical consumer = understanding choices when it comes to spending and saving, being able to explain the difference between what they want and what they need.

Managing risks and emotions associated with money = understanding the different places money can be kept and the consequences of it being lost or stolen. Being able to explain a savings goal and how they will achieve it.

Understanding the important role money plays in our lives = being able to describe where their money comes from now, and how this might change in the future e.g through earning a wage.

You can find lots of MoneySense resources for parents and children on these themes here.

Image credits: iStock, Stocksy

Find out about all the latest MoneySense articles for parents by following us on Facebook

Related activities

Want your child to find out more for themselves? Here are some activities to share with them.

Activities:

Activities:

Interactive activity:

Interactive activity:

Poster:

Poster: